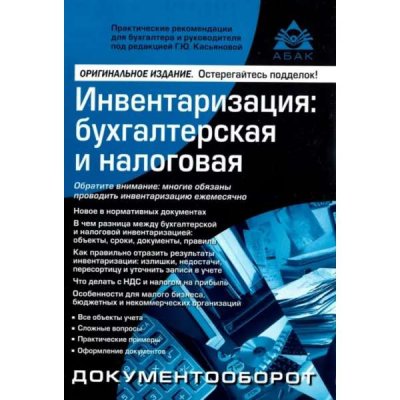

Inventory. Accounting and tax

All organizations are required to take inventory at different intervals. Serious consequences may result from both non-conducting and incorrect registration of inventory results. This publication describes in detail how and in what cases it is necessary to carry out an inventory, how to document it and reflect the results in accounting (accounting and tax). The material is richly illustrated with practical examples with postings and explanations for filling out each document. All recommendations are given taking into account the requirements of the current legislation, as well as tax authorities, presented during documentary inspections. It is addressed to a wide range of readers, individual entrepreneurs, accountants and managers of enterprises and organizations of all forms of ownership. It can be used as a teaching aid. 11th edition, revised and expanded.

No reviews found